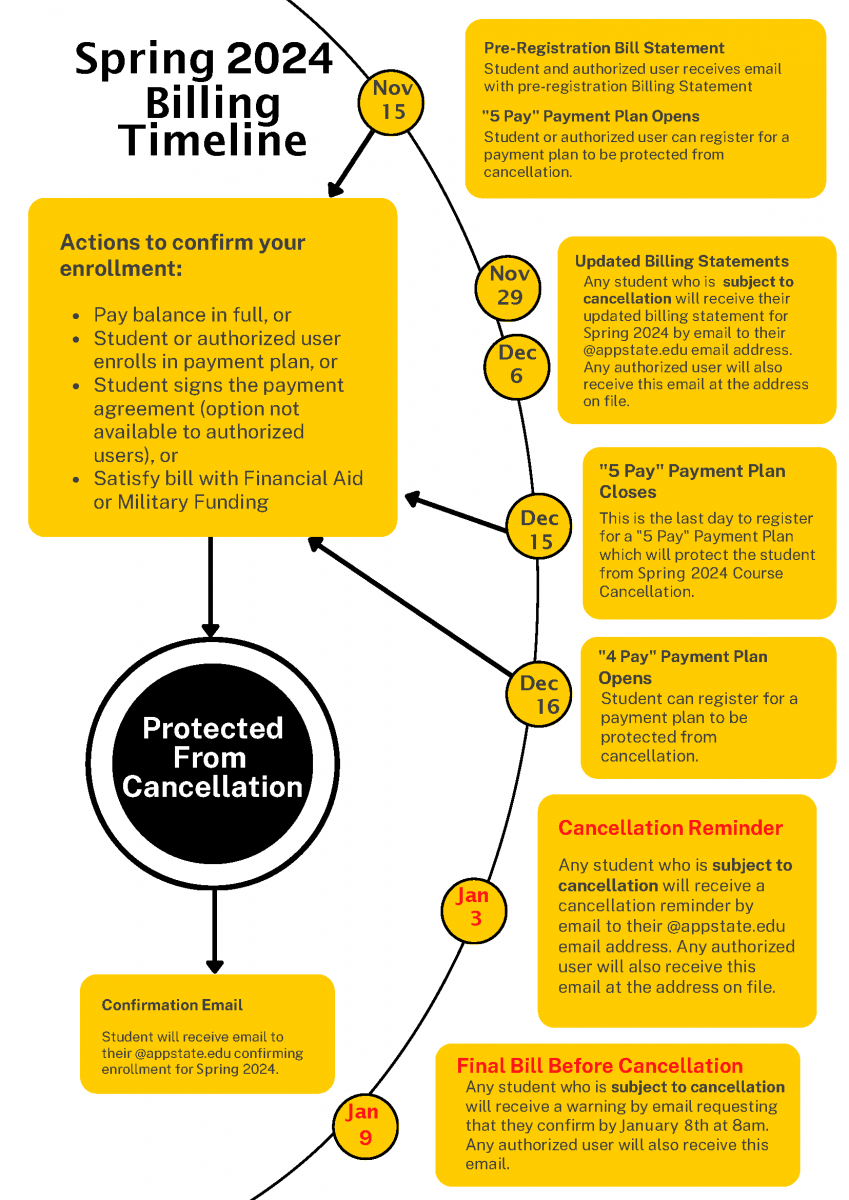

Spring 2024 Tuition and Fee Payment Timeline

PLEASE NOTE: You must satisfy your outstanding balances or complete one of the following to avoid Course Schedule Cancellation for Nonpayment at 8am on Tuesday January 9th, 2024:

(if sending a payment via mail or courier the check must arrive in our office by 3pm on Friday January 8th, 2024 to avoid cancellation)

- Pay Balance in full;

- Pay balance except for amount that is pending on account associated with student financial aid

- Set up a Payment Plan and pay as agreed for Spring 2024

- Provide Military Funding Authorization to ASU Office of Student Financial Aid well in advance of the cancellation deadline. We also recommend these students to complete the Payment Agreement in the Touchnet Billing and Payments Portal.

- Student (not parent or authorized user) logs into the Touchnet Billing and Payment Portal and agrees to the payment agreement used when the student has an identified method of payment that will cover the full cost of charges associated with attending Spring 2024 and that has timing issues that may result in cancellation if not otherwise agreed to.

Bills are generated in July for Fall, November for Spring, and April for Summer. Additional supplemental billing is sent frequently after the first bill. All billing for current students is sent via email to the student's @appstate.edu email account. For billing to be sent to other users such as parents or third parties they must be added in the Touchnet Billing and Payment Center prior to each billing. Instructions to add authorized users in Touchnet can be found here.

Students who have left ASU and have outstanding balances on their Student account are emailed and mailed statements for two consecutive months prior to the University beginning collections activity.

For more information, click on the links provided on the left.